As we hit 2026, the Wild West phase of crypto is over. We’ve moved from building the plumbing to owning the rails. The winners turned from having the ones with the most users to becoming the “Default Answer” for the world’s financial questions.

This is the Consolidation of Meaning: shifting from being a “crypto tool” to being the primary way the world interacts with value.

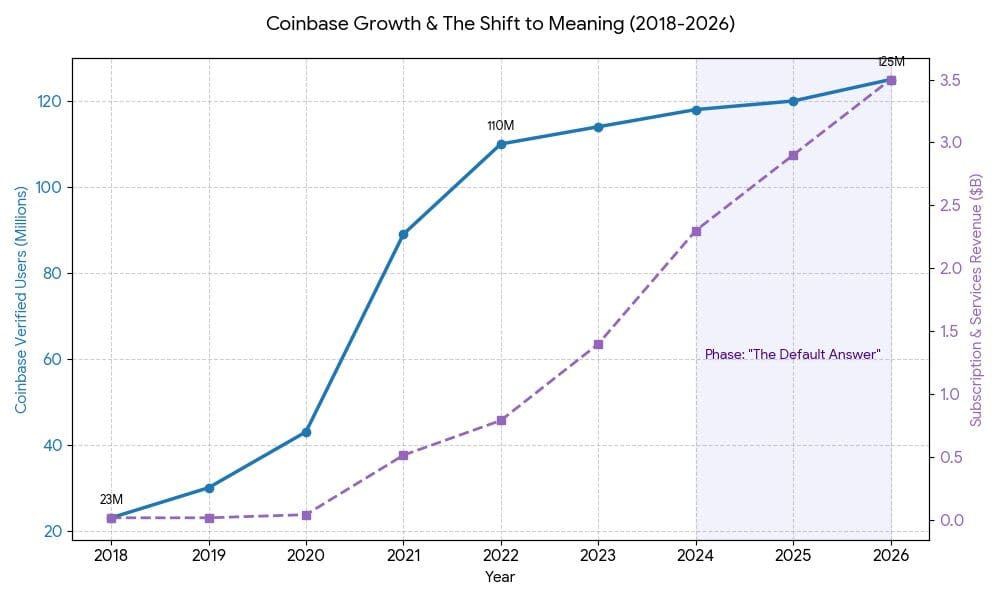

From the explosion of Polymarket as a definitive source of global truth to Coinbase’s aggressive rebranding, the goal is to become the singular interface where the world interacts with value.

The Coinbase Blueprint: Mastering the Majority Stand

Coinbase’s recent pivot into the “Everything Exchange” integrating equities, derivatives and prediction markets represents the ultimate masterclass in strategic dominance. They’ve moved beyond being a “crypto platform” to becoming a full-stack financial operating system.

With platform assets surpassing $500 billion this year, Coinbase is leveraging its core exchange stability to systematically eliminate gaps in the market.

- Acquisition as R&D: Their recent shopping spree, including the $2.9B deal for Deribit and the acquisition of The Clearing Company for prediction markets, shows they are plugging holes in their ecosystem faster than any startup can build them.

- The Revenue Pivot: By shifting their revenue mix, where subscriptions and services now account for 40% of net revenue, Coinbase has decoupled from retail volatility. They’ve transformed from a “volatile brokerage” into a “market monster” that thrives regardless of price action.

The Invisible Infrastructure

The most successful players in 2026 have stopped selling “decentralization” and started selling “familiarity”. We’ve reached a point where the tech must become invisible for the meaning to survive.

“Crypto is everything people don’t understand about technology, combined with everything they don’t understand about finance.”

Coinbase’s success isn’t about teaching users how a blockchain works, it’s by making it invisible. Their Base network is the proof: by processing over $300 billion in value by Q3 2025, it proved that when you make the on-chain experience invisible, the users come and stay..

Why Depth Beats Generalization

Coinbase is playing a horizontal game to own the entire financial stack. But in its shadow, a new breed of specialists is thriving by choosing depth over hype.

- The Regional Powerhouse (VALR): VALR is a masterclass in regional execution. In Africa, they out-maneuvered global giants by focusing on the “Native Way.” Their partnership with Mukuru to launch a USDC wallet via WhatsApp didn’t ask 17 million customers to learn a new app; they met them where they already live. That is the definition of vertical UX.

- The Professional Specialist (Kraken): While Coinbase courts the “everyone” demographic, Kraken has doubled down on the vertical trader. By focusing on “bank-grade” compliance (Kraken Pro) and specialized liquidity, they cater to the market that values depth over the “Everything” sprawl.

Communication as the Translation Layer

In 2026, crypto PR is more than a megaphone for hype, it is a Translation Layer. Its role is to take the abstract (L2s, ZK-proofs, liquid staking) and turn it into a visceral narrative of safety and long-term wealth.

Coinbase doesn’t obsess over features; it emphasizes regulation and presence. In a space that has historically burned its users, trust is the only currency that doesn’t devalue. Effective communication doesn’t just describe a product; it frames the product as a solution to a societal pain point.

The Directive for 2026

Success in the next year will belong to the projects that understand three things:

- Credibility is Currency: Master your core niche before you attempt an ecosystem.

- Meaning Trumps Tech: If your value proposition requires a whitepaper, your narrative has already failed.

- Focus Beats Sprawl: Identify a specific pain point, like Farzam did with VALR’s cross-border remittances, and solve it so perfectly that the technology becomes invisible.

The future of Web3 won’t be won by the most complex products, but by the clearest ones.

Is your narrative still speaking “tech” instead of “meaning”?

Don’t let your breakthrough get lost in the noise. At MarketAcross, we build the narratives that turn protocols into household names. Since 2014, we’ve helped the world’s leading blockchain projects bridge the gap between abstract tech and global adoption.

Ready to find your “Default Answer”? Let’s refine your 2026 narrative