Intro

Web3 may be borderless by design, but when it comes to adoption, regulation, and community-building, location still matters. A lot.

What works in the U.S. might fall flat in South Korea. What clicks in Europe may need a complete reframe in Latin America. To take your crypto project global, you need more than a killer product — you need cultural fluency, regulatory awareness and boots-on-the-ground strategy.

To navigate this landscape, we broke down the key differences across the U.S., Asia, Europe and Latin America, and how to adapt your marketing and messaging for each.

At MarketAcross, we’ve helped hundreds of leading Web3 projects launch, scale, and resonate across these regions, from high-stakes token drops to long-term brand building.

Buckle up, your global go-to-market journey starts now.

United States: From Retail Hype to Institutional Game

The U.S. remains the largest financial market in the world, and crypto is no exception. But the definition of a “crypto audience” in the U.S. has changed dramatically.

Not long ago, the U.S. crypto scene was dominated by retail traders, NFT flippers, and online-native communities. Today, we’re witnessing a major pivot toward institutions: family offices, hedge funds, asset managers, and traditional finance players are entering the space, especially as regulatory sentiment begins to shift.

The 2024 U.S. elections and Donald Trump’s pro-crypto stance have helped flip the narrative from regulatory uncertainty to cautious optimism. But that momentum remains fragile, and the narrative can shift quickly.

How to Adapt:

- The U.S. is now a B2B/institutional-first market. Founders should tailor their messaging to speak directly to professionals in traditional finance — not just crypto-native enthusiasts.

- The utility vs. security debate has faded. Today’s token issuers openly position tokens as financial assets — with clear value propositions and investment rationale.

- Less blockchain jargon, more transparency. U.S. audiences respond to clarity, compliance-minded language, and realistic ROI — not overhyped tech talk.

dYdX is a clear case study in how crypto projects are maturing to meet the expectations of institutional markets. In its October 2025 Analyst Call, dYdX announced new features built for professional traders, from advanced order types to integrated staking, alongside plans to enter the U.S. market.

With over $1.5T in lifetime trading volume, CEO Charles d’Haussy described the shift as “a growing preference for decentralized infrastructure built with institutional‑grade standards.” It’s a clear sign that credibility and compliance now define the next phase of crypto growth in the U.S.

From dydx monthly analyst call

Asia: Speculation, Speed and Localized Trust

Asia remains one of crypto’s most retail-driven markets, especially in countries like South Korea — which accounts for over 25% of all global retail crypto liquidity. From Japan to Hong Kong, Asia has long embraced speculative assets, fast trading, and high-risk/high-reward behavior.

Institutional adoption is growing, but retail dominance still defines the region. And in Asia, trust is built locally. Projects without a physical presence or region-specific operations often struggle to gain traction.

How to Adapt:

- Asia rewards presence. Setting up local P&L centers, developer hubs, or even investing in regionally relevant use cases can accelerate credibility.

- Partnerships matter. Collaborate with well-known banks, payment providers, or gaming publishers in the region to signal commitment.

- This is a “boots-on-the-ground” market — not one where remote launches and global tweets can do the heavy lifting.

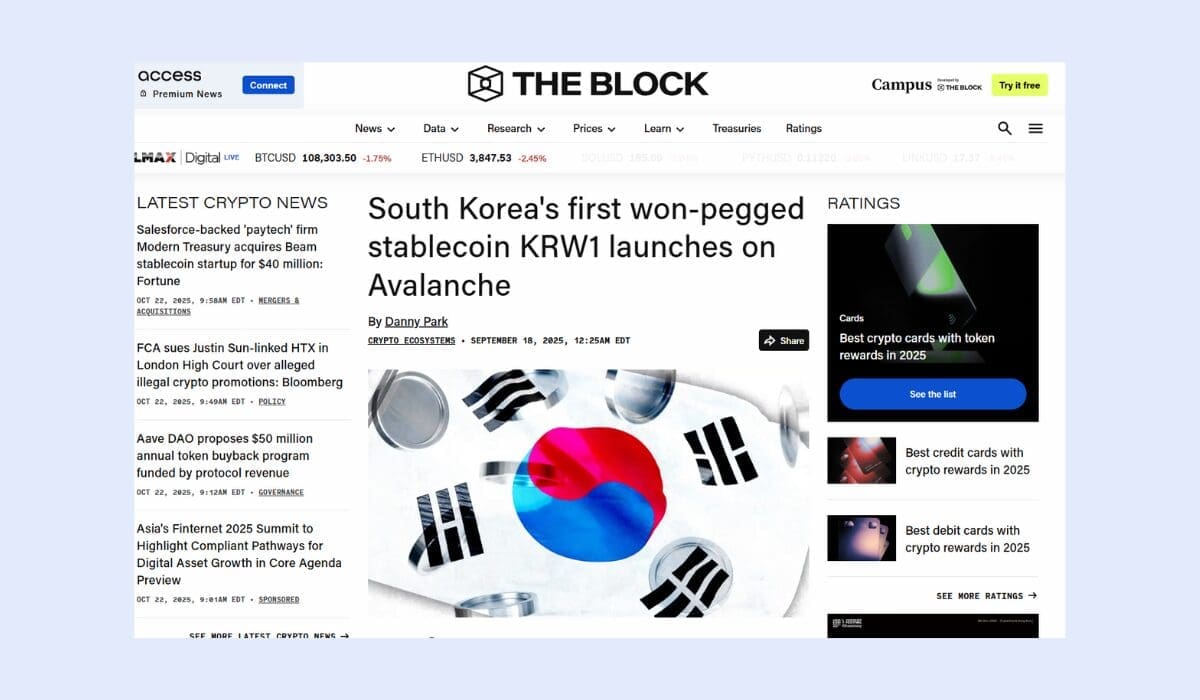

For example, Avalanche’s collaboration with BDACS to launch KRW1, South Korea’s first won-pegged stablecoin, shows how going local pays off. The token is fully backed by fiat held at Woori Bank, with real-time banking APIs and plans for integration into public-sector services like emergency relief. More than a product launch, this was a region-specific play aligned with South Korea’s monetary and regulatory priorities — proving that success in Asia requires tailored infrastructure, trusted partners and a deep understanding of local narratives.

Article from The Block

Europe: A B2B Market in Regulatory Limbo

Europe was one of the first regions to roll out a comprehensive crypto framework — MiCA, but its rigid structure has slowed innovation. While the rules are now clearer, they are also stricter, and many companies are reluctant to commit until things stabilize.

That said, interest from financial institutions and banks is growing. The appetite is real, but the path forward requires compliance and patience.

How to Adapt:

- Compliance is not optional. Launching in Europe means understanding MiCA, obtaining licenses, and establishing local subsidiaries.

- Focus on institutional engagement. Retail adoption is lower due to economic constraints, so messaging should reflect a B2B approach.

- Europe is cautious but curious — players are waiting for the “safe” moment to enter. Positioning as a compliant, long-term partner matters.

Take Crypto.com, for example: Rather than waiting for MiCA regulations to settle, they proactively secured a MiFID license via the acquisition of a Cyprus-based financial firm, enabling it to offer regulated crypto derivatives across the European Economic Area. Rather than waiting on the sidelines, Crypto.com leaned into compliance, building a legal and operational base that aligns with Europe’s evolving regulatory frameworks. It’s a clear reminder: in Europe, licensing isn’t a checkbox — it’s a strategy.

Article from Cointelegraph

Latin America: Real-World Use Cases Take Center Stage

While other regions chase hype, Latin America brings crypto back to its roots: financial empowerment. In countries like Venezuela and Argentina, where hyperinflation is the norm, crypto is used as a store of value, a remittance tool, and an alternative to unstable fiat currencies.

From El Salvador’s historic adoption of Bitcoin as legal tender to growing grassroots interest in DeFi, the region is becoming a powerful case study for crypto’s original promise.

How to Adapt:

- Focus on usability. Users here care less about staking mechanics and more about whether they can send money to their families.

- Education and accessibility matter. Clear interfaces, multilingual support, and mobile-first design can go a long way.

- This region isn’t just a “future” opportunity — adoption is already happening. Devcon 2024’s choice of Buenos Aires is no coincidence.

Latin America may still be in the early stages of mass adoption, but the momentum is unmistakable. As macroeconomic pressures intensify, this region is quickly evolving into one of the most compelling real-world use cases for crypto.

Don’t Skip the Stage

Expanding globally doesn’t happen from behind a laptop alone. Conferences like TOKEN2049, KBW and Paris Blockchain Week are more than just speaking gigs, they’re high-stakes touchpoints for media, partners, investors and community.

If you’re serious about entering a new region, knowing how to work the event circuit is critical.

We created a guide on how to maximize you next crypto event, as well as curated all of the major crypto events you shouldn’t miss out on.

The Market Across team during Zebu Live 2025

Final Thoughts

There’s no one-size-fits-all strategy for global crypto growth. What resonates in Seoul might fall flat in San Francisco. What succeeds in Berlin may never land in Buenos Aires. But by understanding how regional narratives, behaviors, and regulations shape adoption, and by adapting your go-to-market playbook accordingly — crypto projects can go global in the most meaningful way.

At MarketAcross, we know how to localize strategy without losing sight of the big picture, helping projects scale across borders with precision, relevance, and long-term impact.

Want to go global the right way? We’ve Got You Covered.